Success history of the team headed by Ales Loprais can become your success history! Trade confidently and head towards leadership like regular participant of Dakar Rally and winner of Silk Way Rally InstaForex Loprais Team does it!

Join in and win with InstaForex!

13.01.2025 03:44 PM

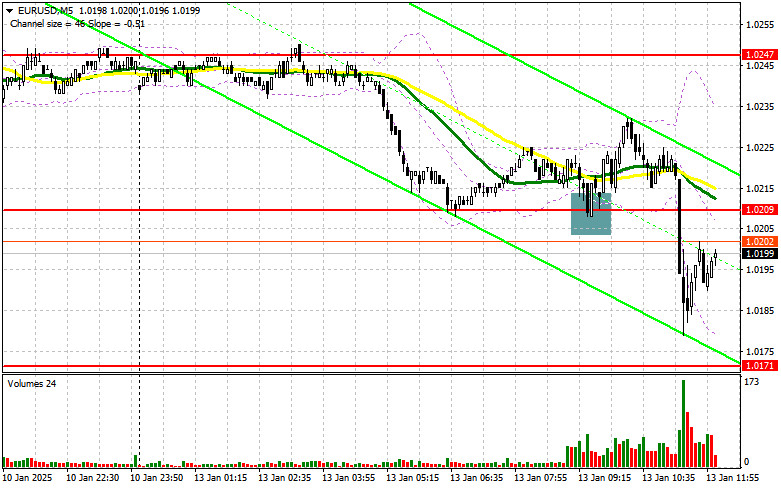

13.01.2025 03:44 PMIn my morning forecast, I highlighted the level of 1.0209 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by the formation of a false breakout at that level provided a buying opportunity, which resulted in a 20-point growth before pressure on the pair resumed. The technical picture for the second half of the day remains unchanged.

The euro remains under pressure, which is unsurprising. Following US news and statements by European policymakers about the possibility of more aggressive rate cuts by the European Central Bank, there is little hope for upward momentum in the EUR/USD pair. Unfortunately, there are no significant economic data releases from the US this afternoon, so it is better to continue acting in line with the existing bearish trend while remaining cautious about potential corrections in the pair.

If pressure on the pair persists, I plan to act only around the nearest support at 1.0176, which narrowly missed a test during the first half of the day. A false breakout formation at this level would provide a good buying opportunity, aiming for resistance at 1.0219. A breakout and retest of this range from above would confirm a proper entry point for further buying, with targets at 1.0247. The ultimate target will be the 1.0277 high, where I plan to take profits.

If EUR/USD continues to decline and there is no bullish activity around 1.0176 in the afternoon, the pressure on the pair will likely increase, allowing sellers to reach 1.0132, a new yearly low. Only after a false breakout there would I consider entering long positions. I will open long positions on a direct rebound from 1.0090, targeting a 30-35 point upward correction during the day.

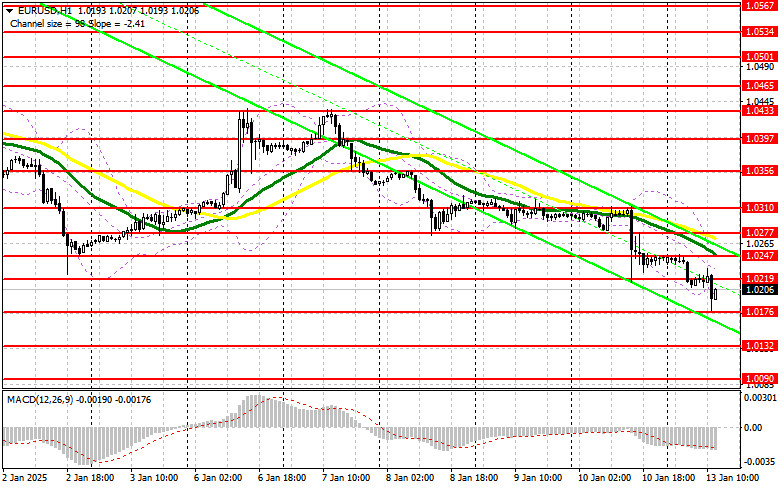

Sellers wasted no time resuming pressure on the euro, aiming to reach parity with the dollar in the coming weeks. Given the lack of US statistics this afternoon, the pair may experience a correction, so caution with shorts is advised. A false breakout at 1.0219 would provide an entry point for short positions, aiming for support at 1.0176. A breakout and consolidation below this range, followed by a retest from below, would serve as another suitable selling opportunity, targeting the yearly low at 1.0132, which would strengthen the bearish trend. The ultimate target will be 1.0090, where I plan to take profits.

If EUR/USD moves higher in the second half of the day and sellers fail to show activity around 1.0219, where moving averages are also bearish, I will postpone short positions until the next resistance test at 1.0247. I will sell there only after a failed consolidation. I plan to open short positions on a direct rebound from 1.0247, aiming for a 30-35 point downward correction.

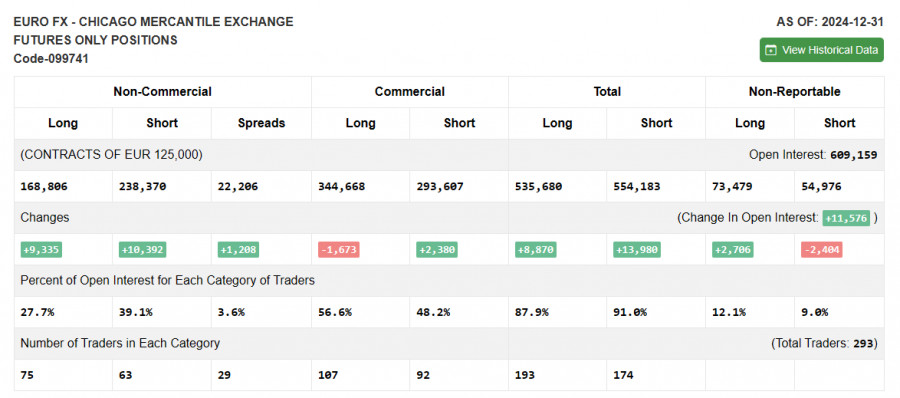

The COT report for December 31 showed nearly equal growth in both short and long positions. Considering that the Federal Reserve's policy remained unchanged before the new year, attention is likely shifting to Donald Trump's inauguration and his protectionist rhetoric. However, any statements by Federal Reserve officials will also play a significant role in the future course of the US dollar and should not be ignored. The COT report indicates that long non-commercial positions increased by 9,335 to 168,806, while short non-commercial positions increased by 10,392 to 238,370. As a result, the gap between long and short positions widened by 1,208.

Moving Averages:

Trading occurs below the 30- and 50-day moving averages, indicating further pair declines.

Note: The author considers moving averages on the H1 chart, which may differ from the classic D1 definition.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.0205 will act as support.

You have already liked this post today

*Disclaimer: The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have any content questions, please contact editorial-board@instaforex.com

If you have any content questions, please contact editorial-board@instaforex.com

In my morning forecast, I focused on the 1.2429 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.0415 level and planned to make trading decisions around it. Let's review the 5-minute chart to see what happened. A decline occurred

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair exhibited mixed movements. Initially, the price dropped before rising again, only to experience a more significant

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair exhibited mixed movements due to a lack of macroeconomic background and fundamental economic data. The British pound

On Monday, the GBP/USD pair exhibited upward movement, even though there were no significant events scheduled in either the UK or the US. During a technical correction, the market often

On Monday, the EUR/USD pair experienced a slight correction before resuming its upward movement. The only scheduled event for the day was a speech by Christine Lagarde. Although she spoke

In my morning forecast, I focused on the 1.2420 level and planned to make trading decisions from there. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I focused on the 1.0450 level as a key area for making entry decisions. Reviewing the 5-minute chart, the price declined but fell short of testing

On Friday, the GBP/USD currency pair showed a strong upward movement. Most of the observations made in the EUR/USD analysis can also be applied to GBP/USD. While the euro

The EUR/USD currency pair experienced significant growth on Friday. In our fundamental articles, we provided a detailed explanation for this current trend. A few weeks ago, we predicted a correction

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.