The cryptocurrency market has been developing rapidly this year. Thus, it will be very interesting to look at the future prospects of the crypto markets, given that the current year has become an epoch-making one for them, without exaggeration, and since all markets are interconnected and cannot develop in isolation, then inter-market technical analysis, as they say, rules, and in this context, we will consider the dynamics of Bitcoin in the future for the next one to three months.

But first, let's talk about what events became milestones for the cryptocurrency market in the outgoing year, and the main ones were:

- The increase in the capitalization of Bitcoin above $1 trillion, which occurred in February 2021, due to the increase in the BTCUSD rate to the level of $57,000, and an increase in the capitalization of the cryptocurrency market over $3 trillion, which happened in November 2021.

- A sharp rise in interest in projects based on non-fungible tokens (NFTs), which spurred the sale of the work "Everydays: The First 5000 Days," by artist Mike Winkelmann, also known as Beeple, for $69 million.

- El Salvador's adoption of Bitcoin as a national currency, which, despite criticism from international financial institutions, made BTC a national means of payment.

- The launch of the Ethereum London EIP-1559 update, which will eliminate mining of this cryptocurrency by mid-summer 2022, which will reduce the environmental impact of ETH by 99% and herald a new turn in the development of cryptocurrencies.

- The launch of the first exchange-traded ETF ProShares BITO in the U.S., following cryptocurrency and allowing investors to invest in bitcoin futures contracts, much like they do now in commodity exchange-traded funds such as oil.

- China's ban on any activity related to the cryptocurrency market.

Moreover, the restrictions imposed by China are indicative for investors. First, they give us a clear understanding of how the central banks will act in the event that trading and mining of cryptocurrencies will pose a threat to the national currency and the economy. Second, the exponential growth of the cryptocurrency market after China made the decision to ban it confirms the hypothesis that the fate of this segment, like any other financial instrument, is decided in the United States.

The analysis of these events gives us an understanding of how cryptocurrencies will behave in 2022, comparing their dynamics with the dynamics of dollar liquidity in the system, because so far cryptocurrencies are not an independent segment of the economy and depend on how much fiat money is in circulation, as well as the possibility of exchanging cryptocurrency for dollars, euros, pounds etc. In this regard, the policy of key Central Banks is decisive not only for traditional markets, but also, despite decentralization, is of crucial importance for the cryptocurrency exchange rate.

As you know, in December 2021, the U.S. Federal Reserve decided to accelerate the completion of the quantitative easing program in 2022, postponing its end from July to March. In addition, as the "dot charts" published following the FOMC meeting show, next year the Committee may raise the rate three times, and this should lead to a decrease in the amount of money in the system.

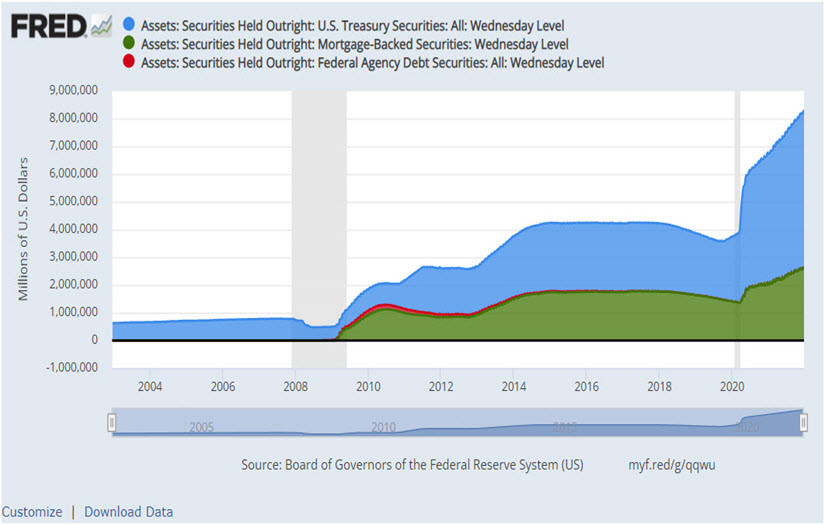

There is no bigger secret that the rise of crypto markets has been driven by cheap liquidity pumped into the system in 2020-2021. Earlier, the Fed has conducted three quantitative easing programs, each of which led to the growth of the cryptocurrency market (Figure 1). I think that each of us is able to understand this causal relationship.

Figure 1: Assets on the balance sheet of the U.S. Federal Reserve and 4 stimulus programs 2009-2021

If we assume that the dynamics of the Fed's balance sheet will develop as it did from 2016 to 2019, when the asset level was at a constant value and even decreased, then this will give an understanding that the bitcoin exchange rate next year will at best remain in the range of $30,000-$60,000, and at worst everything can be, and the scenario of a decline to the level of $20,000 is not the worst option.

These are, of course, fantasies on the topic, but for investors who are planning to buy bitcoin now, "while it is selling cheap," it would be nice to try on just such a negative scenario for your deposit. Naturally, buying for 30 and selling for 60 is a great option, but buying for 45 and selling for 20, I think, will not be liked by anyone.

In the context of the development of this forecast, let's look at the short-term prospects of BTCUSD using technical analysis. As follows from the dynamics of the rate during the daytime, at the moment bitcoin remains in an upward trend, while the strength and length of the correction to this trend allow us to consider scenarios for a further continuation of the decline. In this case, the most negative scenario will be that the corrective decline will develop further, and the price will drop below $40,000 (Fig. 2). In this case, the trend of the daytime will change its direction from an increase to a decrease, which in the future will most likely lead to the fact that the BTCUSD rate will fall to the level of $30,000.

Fig. 2: Chart of the BTCUSD rate in 3 Line Break format

At the moment, bitcoin traders may consider buying as their priority, but do it exactly until the level of $46,200 is overcome from top to bottom. At the same time, overcoming the level of $46,200 will require them to take a pause in opening long positions and follow the further development of the situation, since in this case there is a high probability that the BTCUSD rate will drop to the level of $40,000, and this level is a local pivot point of the daytime and separates the upward trend from the downward trend.

There is a long-term positive trend in the cryptocurrency market now, but January is a bad month for all markets. According to statistics, over the past 20 years, in 55% of cases, January on stock exchanges closed with a decrease to the opening, which means that investors are rejecting risks, which directly has a negative impact on cryptocurrencies. Therefore, when deciding to trade on New Year's holidays, be extremely careful and follow the rules of money management.