Review :

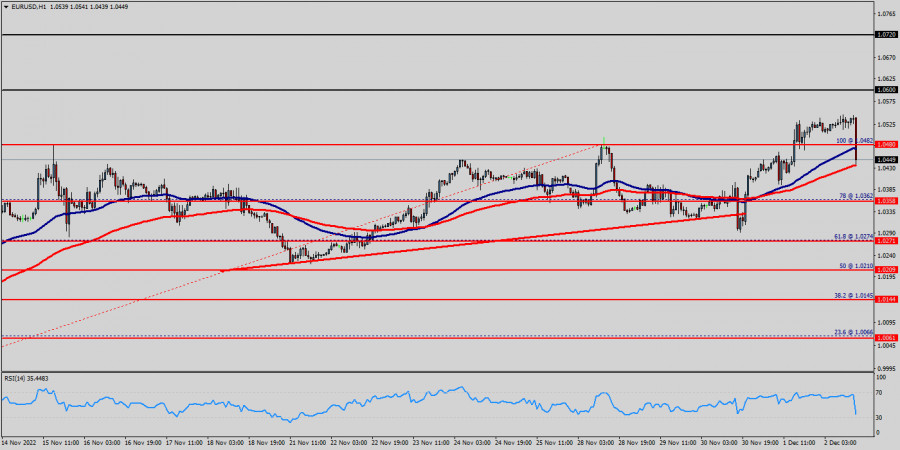

The EUR/USD pair has faced strong resistances at the levels of 1.0425 because support had become resistance on Nov. 29, 2022. So, the strong resistance has been already formed at the level of 1.0425 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 1.0425, the market will indicate a bearish opportunity below the new strong resistance level of 1.0425 (the level of 1.0425 coincides with a ratio of 78% Fibonacci). Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). The EUR/USD pair continues to move downwards from the level of 1.0480. Yesterday, the pair dropped from the level of 1.0480 to the bottom around 1.0300. But the pair has rebounded from the bottom of 1.0300 to close at 1.0333. The EUR/USD pair's outlook and further decline is expected with 1.0425 minor resistance intact.

Current down trend should move from the last resistance levels of 1.0425 and 1.0482. Firm break there could prompt downside acceleration to last bearish wave of 1.0425 and 1.0482 (these resistance levels have been rejected several times confirming the veracity of a downtrend). Today, the first support level is seen at 1.0300, the price is moving in a bearish channel now. Furthermore, the price has been set below the minor resistance at the level of 1.0284, which coincides with the 23.6% Fibonacci retracement level. Thus, the market is indicating a bearish opportunity below 1.0425 so it will be good to sell at 1.0425 with the first target of 1.0300. It will also call for a downtrend in order to continue towards 1.0271. The daily strong support is seen at 1.0271. On other hand, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.0480.

The bullish trend is currently very strong for the EUR/USD pair. As long as the price remains above the support at 1.0274, you could try to take advantage of the bullish rally in short term. This price (1.0274) is coincided with the ratio 61.8% of Fibonacci retracement levels. The first bullish objective is located at 1.0403. The bullish momentum would be revived by a break in this resistance. For three weeks the EUR/USD pair increased within an up channel, for that the trend these new highs 1.0480. The EUR/USD pair had a significant breakout above the price of 1.0274 and 1.0300. The EUR/USD pair is part of a very strong bullish trend. Traders may consider trading only long positions as long as the price remains well above the levels of 1.0274 and 1.0300. Currently, the price is in a bullish channel.

This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. As the price is still above the moving average (100), immediate support is seen at 1.0274, which coincides with a golden ratio (61.8% of Fibonacci). Consequently, the first support (minor support level) is set at the level of 1.0300. Hence, the market is likely to show signs of a bullish trend around the spot of 1.0300 and 1.0274. The next resistance located at 1.0480 is the next bullish target to be reached. A bullish break in this resistance would boost the bullish momentum. The bullish movement could then continue towards the next resistance located at 1.0500. Closing above the pivot point (1.0274) could assure that the EUR/USD pair will move higher towards cooling new highs. The bulls must break through 1.0300 in order to resume the uptrend. Buyers would then use the next resistance located at 1.0482 as an objective (this price is coincided with the ratio 100% of Fibonacci retracement levels - the double top - te last bullish wave on the hourly chart). The EUR/USD pair is bullish but climbing higher will be strict, our next target 1.0500.

Crossing it would then enable buyers to target 1.0550. Be careful, given the powerful bullish rally underway, excesses could lead to a short-term rebound. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. Th trend's price has been consolidating between the 1.0300 USD and 1.0550 over the last few weeks, following a massive rising from the 1.0358 mark. So far, the price has been supported by the 1.0300 and 1.0274 range.