Analysis of Trades and Trading Recommendations for the Euro

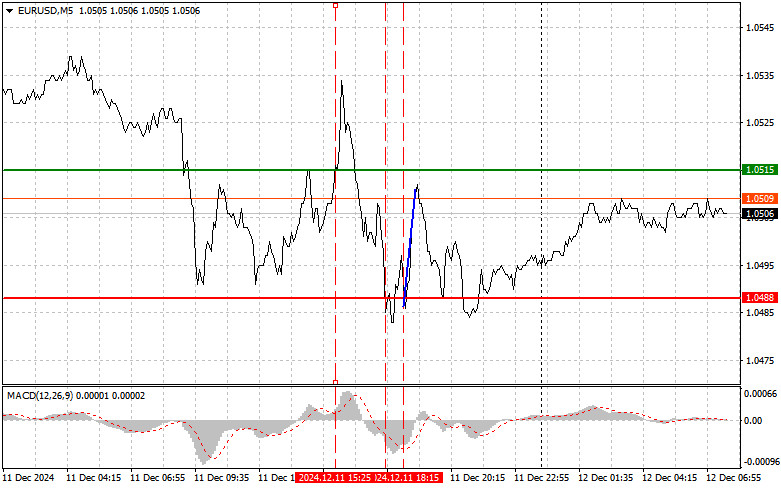

The test of the 1.0515 level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the euro. Following the downward movement of the pair, the test of the 1.0488 level also coincided with the MACD being far from the zero line, raising doubts about further declines in GBP/USD. However, buying during the second test of 1.0488, when the MACD was in the oversold zone, allowed Scenario #2 to play out, resulting in a 20-pip increase.

The currency market immediately reflected the perception of U.S. inflation data released the previous day. Although inflation matched expectations, traders' concerns about the Federal Reserve potentially returning to a more aggressive monetary policy supported the dollar. The strengthening of the U.S. currency affected risk assets, including the euro. Yesterday's events again underscore the connection between inflation expectations and market behavior, as traders seeking to minimize risks turn more conservative, favoring stable assets.

If the European Central Bank confirms its readiness to continue easing monetary policy today, this could exacerbate the euro's sell-off, as traders may further revise their positions and expectations. A significant rate cut could drive capital toward more attractive assets in other currencies, impacting the euro's liquidity and strength on the international stage. Thus, the ECB's final meeting of the year puts the euro at risk of further decline, especially if a softer monetary policy for the coming year is announced.

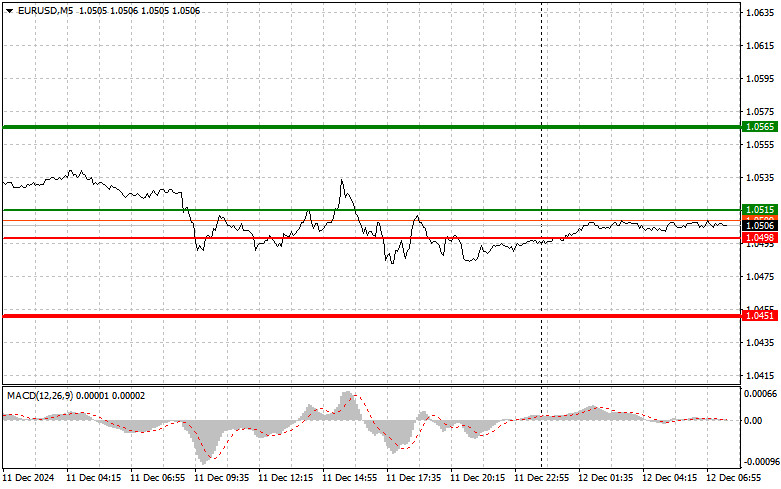

Regarding intraday strategy, I plan to focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the 1.0515 level (green line on the chart) with a target of 1.0565. At 1.0565, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30–35 pips from the entry point. Expecting a euro rise this morning is possible only within a corrective framework.

Important! Before buying, ensure that the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0498 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Expect the price to rise toward the opposite levels of 1.0515 and 1.0565.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.0498 level (red line on the chart). The target will be 1.0451, where I will exit the market and immediately buy in the opposite direction, aiming for a movement of 20–25 pips from the level. Downward pressure on the pair could resume anytime, but selling is better from higher levels.

Important! Before selling, ensure that the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0515 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. Expect the price to decline toward the opposite levels of 1.0498 and 1.0451.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.