Trade Analysis and Tips for the Euro

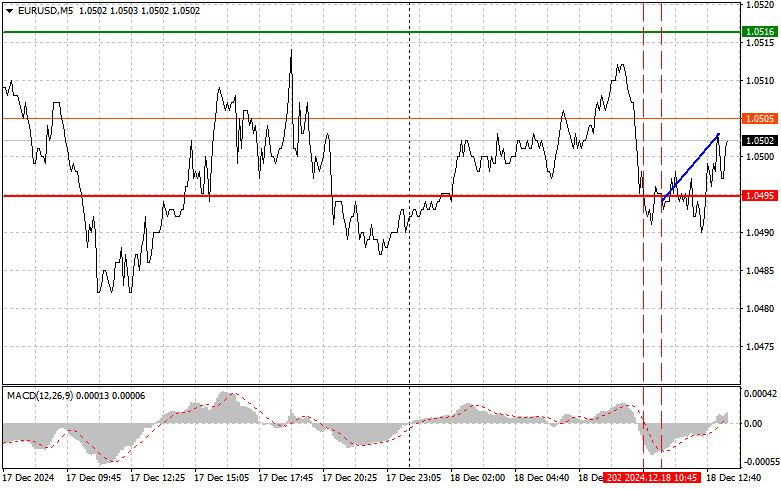

The first test of the 1.0495 price level occurred when the MACD indicator had moved significantly below the zero mark, which I believed limited the pair's downward potential. For this reason, I refrained from selling the euro. A second test of 1.0495 shortly thereafter, when the MACD was in the oversold zone, led to the realization of Scenario #2 for buying. This resulted in only a 10-point gain before volatility sharply declined.

Traders have digested the data on inflation declines in the Eurozone and are now eagerly awaiting the Federal Reserve's statement. Changes in the interest rate could have a significant impact on the US economy. Jerome Powell's forecasts and future monetary policy assessment will not only define short-term strategies for investors but also set expectations for the long term. Market participants will analyze every word, as the tone of Powell's comments could significantly alter the dollar's position in the forex market.

If the Fed Chair hints at pauses in the rate-cutting cycle, this is likely to strengthen the dollar, putting pressure on other currencies, including the euro. Traders will also carefully watch market reactions to potential changes in forecasts for inflation and employment, as these factors are key to monetary policy decisions.

Investors will not only focus on the Fed's immediate decisions but also the broader context, including the global geopolitical situation and the actions of other central banks. This interplay could introduce additional volatility to currency markets, emphasizing Powell's speech as a catalyst for potential shifts.

Regarding intraday strategy, I will rely on the execution of Scenarios #1 and #2.

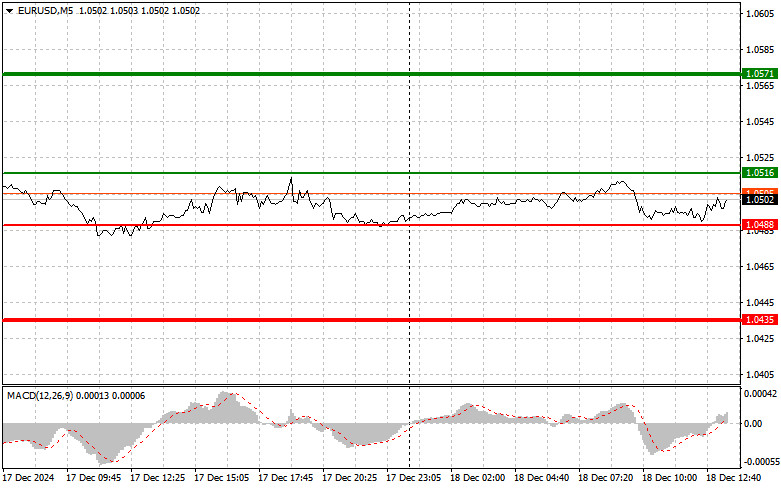

Buy Signal

Scenario #1: Today, buying the euro is possible upon reaching the price level of 1.0516 (green line on the chart) with a target of 1.0571. I plan to exit the market at 1.0571, while also selling the euro in the opposite direction, expecting a 30-35 point pullback from the entry point. A euro rally today can only be expected after a dovish tone from the Fed. Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if the price tests 1.0488 twice consecutively, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upwards. Growth towards the opposite levels of 1.0516 and 1.0571 can be anticipated.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.0488 (red line on the chart). The target will be 1.0435, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20-25 point pullback from the level). Selling pressure on the pair will return in the case of a hawkish Fed stance. Important: Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if the price tests 1.0516 twice consecutively, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downwards. A decline towards the opposite levels of 1.0488 and 1.0435 can be expected.

Key Chart Levels

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Approximate price for setting Take Profit or manually closing positions, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Approximate price for setting Take Profit or manually closing positions, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is essential to monitor overbought and oversold zones.

Important Notes

Beginner forex traders should be extremely cautious when making market entry decisions. It is best to avoid trading before the release of important fundamental reports to prevent being caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially if you trade large volumes without proper money management.

Remember, successful trading requires a clear trading plan, such as the one outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.