On Tuesday, the GBP/USD currency pair did not attempt to correct once again. There was no macroeconomic background that day, but it is difficult to determine what is currently better for the US dollar—news or the absence of it? In any case, the market interprets all positive reports and developments against the dollar. Traders continue to sell off the dollar in response to the new US policies, making this movement seem like a protest. There have been no adverse changes in the American economy or positive changes in the British economy. Yet, the dollar is plummeting as if the Federal Reserve is cutting rates at every meeting, the US economy has already slipped into recession, and everything in the UK is flourishing.

The pound sterling has been rising for over two months, and we strongly doubt that the upcoming Fed and Bank of England meetings will change anything. At this point, it is difficult to understand what is happening in the market and why we are seeing these movements. From the outside, it might seem that the current trend is as simple as it gets. Indeed, what could be easier than a one-sided, inertial movement? Just open long positions every day and make a profit. However, explaining why the British currency keeps rising is challenging, even in hindsight. Why is the market not just reacting to the "Trump factor" but completely ignoring all other factors, news, and data releases?

Therefore, the BoE and Fed meetings can only add to the dollar's problems. Market participants are actively looking for reasons to sell the dollar, and even when they don't find them, they sell anyway. Thus, any slight shift in Powell's rhetoric or the Fed's stance toward a more dovish position will send the dollar plunging further. Conversely, any slightly more hawkish remark from Andrew Bailey will push the pound "to the moon" once again.

The main problem with the current movement is the complete disregard for technical indicators and fundamental data. In other words, it is impossible to determine where this trend might end. The entire pound rally still appears to be a correction on the daily timeframe because the preceding decline was stronger. If not for Donald Trump, we expect the British currency to resume its decline since there are no positive developments in the UK economy. Moreover, the BoE is preparing for more rate cuts in 2025 than the Fed. However, Trump could push the GBP/USD pair past its last high on the daily timeframe, turning the current movement into a full-fledged trend. But that would happen after a 1,300-point rally. Therefore, we continue to highlight the illogical nature of this movement and the difficulty of predicting it. Even if the pair suddenly crashes today or tomorrow, it would not be surprising—the rally has lasted too long, moved too far, and has been too irrational. There have barely been any corrections!

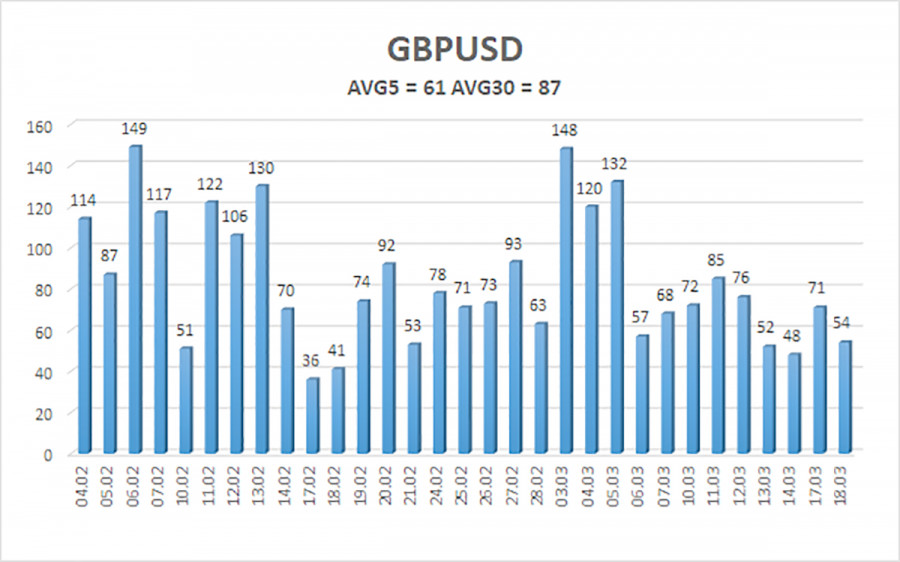

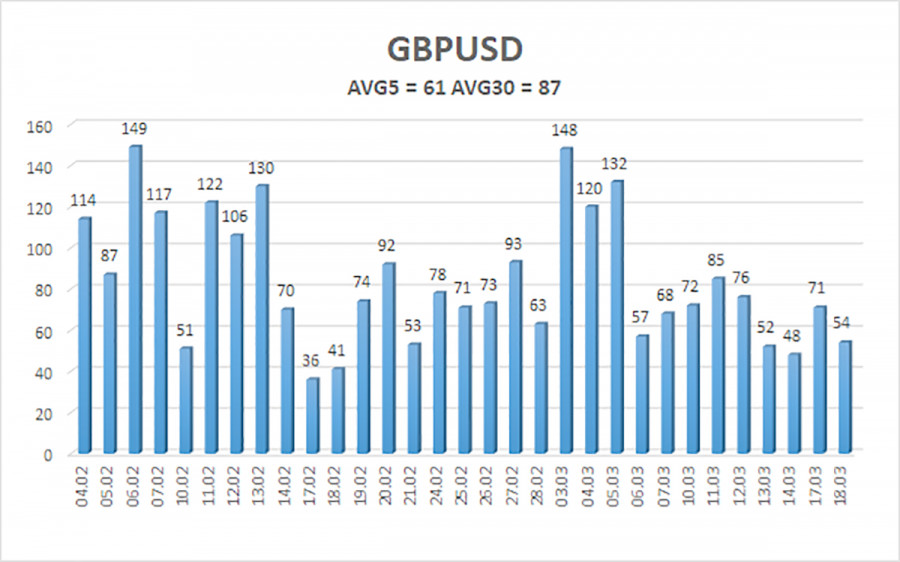

The average volatility of the GBP/USD pair over the past five trading days is 61 pips, which is classified as "moderate-low" for this pair. On Wednesday, March 19, we expect the pair to trade within the range of 1.2934 to 1.3056. The long-term regression channel has turned upward, but the overall downtrend remains intact, as seen in the daily timeframe. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend, but the strong upward movement continues in the four-hour timeframe. We still do not consider long positions since we believe the current rally is a correction that has turned into an illogical, panic-driven surge. However, if you trade purely on technical analysis, long positions are valid with targets at 1.3056 and 1.3062 if the price is above the moving average. Sell orders remain attractive, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end. The pound sterling appears extremely overbought and unjustifiably expensive, but Donald Trump continues to push the dollar into the abyss. Predicting how long this "Trump-driven" dollar collapse will last is challenging.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.