Analysis of Trades and Trading Recommendations for the Euro

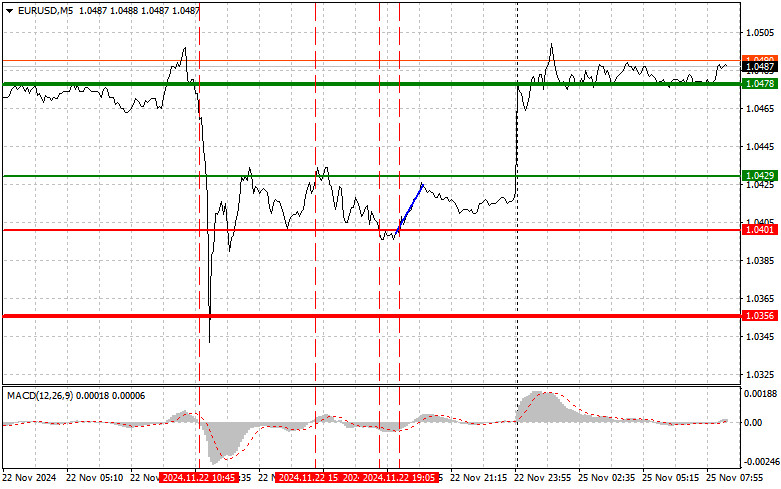

The test of the 1.0429 price level coincided with the moment when the MACD indicator started moving upward from the zero line, confirming a valid entry point to buy the euro. However, the trade resulted in losses as no price increase followed. During the middle of the U.S. session, the test of the 1.0401 price level occurred when the MACD was in the oversold zone, limiting the pair's downward potential. Shortly afterward, a second test of this level provided a good opportunity to buy. As a result, the pair rose by 20 pips, but the upward movement ended there.

Despite the strengthening of the dollar, risks associated with inflation and changes in financial policy may lead to additional volatility, as seen over the weekend. The appointment of Scott Bessent as the new U.S. Secretary of the Treasury allowed the euro to rise significantly. Known for his cautious stance in the financial world, news of his appointment has given investors hope for stability and predictability in the financial sector. The euro's growth against the dollar indicates that the market is beginning to receive positive signals about the potential for softer trade wars planned by the Trump administration. On the other hand, uncertainty stemming from Trump's strict policies will likely continue to cause fluctuations in financial markets, prompting traders to remain vigilant. In such conditions, Bessent's skillful approach to financial policy regulation could be a key factor in ensuring stability and boosting investor confidence.

This morning, traders eagerly await the release of the IFO Business Climate Index from Germany. This index is one of Germany's key economic indicators, reflecting the current state of the economy and business sentiment. An increase in the index would signal positive trends in economic development, potentially strengthening the euro's position in international markets. Additionally, attention should be paid to the IFO Current Assessment Index, which helps determine how businesses evaluate their situation and operations. High values of this indicator may reflect business confidence, often leading to increased investments and consumer spending. Lastly, the IFO Expectations Index will provide insights into how company leaders perceive economic prospects for the coming months. Optimistic forecasts in this indicator could catalyze market recovery and stock growth, as investors interpret them as signs of stability and confidence in the future. In the case of negative data, the euro is likely to resume its decline.

As for intraday strategy, I will focus on implementing Scenarios #1 and #2.

Buy Scenarios

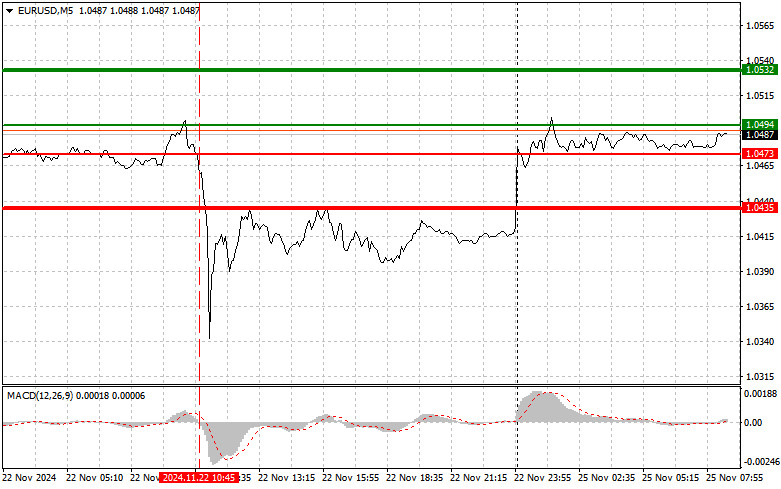

Scenario #1: Today, buying the euro is possible when the price reaches an area of around 1.0494 (green line on the chart) with the target of rising to the level of 1.0532. At 1.0532, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. Relying on euro growth today in the first half of the day is only reasonable after exceptionally positive data and only as part of an upward correction.

Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.0473 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposite levels of 1.0494 and 1.0532 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after reaching the 1.0473 level (red line on the chart). The target will be the 1.0435 level, where I plan to exit the market and immediately buy in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair may return at any moment, but it's better to sell from as high a position as possible.

Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0494 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0473 and 1.0435 can be expected.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Notes for Beginner Forex Traders:

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.