Bizning jamoada 7 000 000 ortiq treyderlar! Har kuni biz treyding yaxshiroq bo'lishi uchun birgalikda ishlaymiz. Yuqori natijalarga erishamiz va oldinga harakatlanamiz.

Butun dunyo bo'yicha millionlab treyderlarning tan olishi - bu bizning ishimizning eng yuqori bahosi! Siz o'z tanlovingizni qildingiz, biz esa Sizning kutishlaringizni oqlash uchun barchasini bajaramiz!

Birgalikda biz zo'r jamoamiz!

InstaForeks. Siz uchun ishlashimizda faxrlanamiz!

13.01.2025 15:44

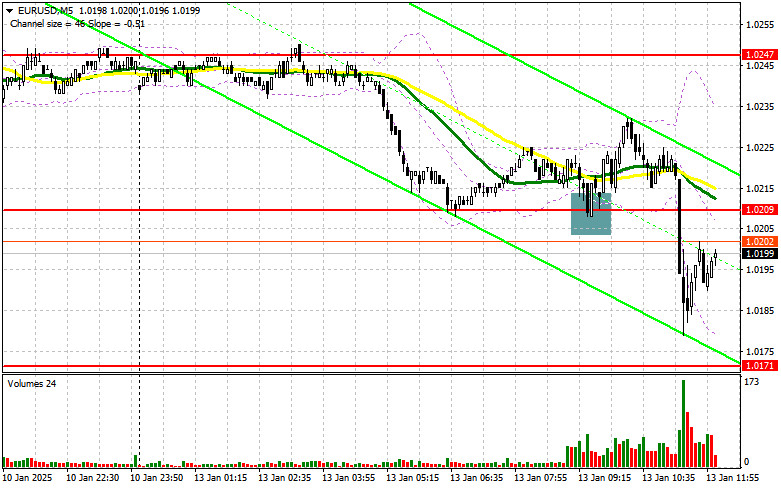

13.01.2025 15:44In my morning forecast, I highlighted the level of 1.0209 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by the formation of a false breakout at that level provided a buying opportunity, which resulted in a 20-point growth before pressure on the pair resumed. The technical picture for the second half of the day remains unchanged.

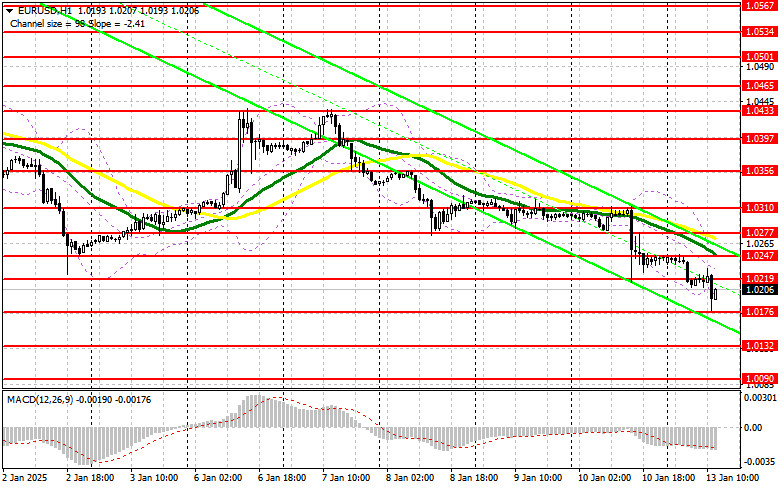

The euro remains under pressure, which is unsurprising. Following US news and statements by European policymakers about the possibility of more aggressive rate cuts by the European Central Bank, there is little hope for upward momentum in the EUR/USD pair. Unfortunately, there are no significant economic data releases from the US this afternoon, so it is better to continue acting in line with the existing bearish trend while remaining cautious about potential corrections in the pair.

If pressure on the pair persists, I plan to act only around the nearest support at 1.0176, which narrowly missed a test during the first half of the day. A false breakout formation at this level would provide a good buying opportunity, aiming for resistance at 1.0219. A breakout and retest of this range from above would confirm a proper entry point for further buying, with targets at 1.0247. The ultimate target will be the 1.0277 high, where I plan to take profits.

If EUR/USD continues to decline and there is no bullish activity around 1.0176 in the afternoon, the pressure on the pair will likely increase, allowing sellers to reach 1.0132, a new yearly low. Only after a false breakout there would I consider entering long positions. I will open long positions on a direct rebound from 1.0090, targeting a 30-35 point upward correction during the day.

Sellers wasted no time resuming pressure on the euro, aiming to reach parity with the dollar in the coming weeks. Given the lack of US statistics this afternoon, the pair may experience a correction, so caution with shorts is advised. A false breakout at 1.0219 would provide an entry point for short positions, aiming for support at 1.0176. A breakout and consolidation below this range, followed by a retest from below, would serve as another suitable selling opportunity, targeting the yearly low at 1.0132, which would strengthen the bearish trend. The ultimate target will be 1.0090, where I plan to take profits.

If EUR/USD moves higher in the second half of the day and sellers fail to show activity around 1.0219, where moving averages are also bearish, I will postpone short positions until the next resistance test at 1.0247. I will sell there only after a failed consolidation. I plan to open short positions on a direct rebound from 1.0247, aiming for a 30-35 point downward correction.

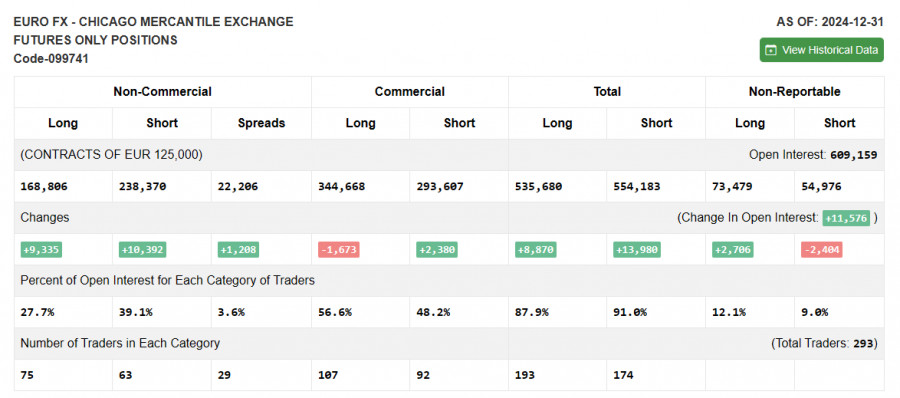

The COT report for December 31 showed nearly equal growth in both short and long positions. Considering that the Federal Reserve's policy remained unchanged before the new year, attention is likely shifting to Donald Trump's inauguration and his protectionist rhetoric. However, any statements by Federal Reserve officials will also play a significant role in the future course of the US dollar and should not be ignored. The COT report indicates that long non-commercial positions increased by 9,335 to 168,806, while short non-commercial positions increased by 10,392 to 238,370. As a result, the gap between long and short positions widened by 1,208.

Moving Averages:

Trading occurs below the 30- and 50-day moving averages, indicating further pair declines.

Note: The author considers moving averages on the H1 chart, which may differ from the classic D1 definition.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.0205 will act as support.

Задайте их нашему топовому аналитику Михаилу Макарову. Присоединяйтесь к его интерактивному вебинару “Экономические события недели: Обзор, Анализ, Прогноз

На вебинаре вас ждет:

Регистрируйтесь на вебинар, чтобы быть в курсе всех рыночных трендов!

Вы сегодня уже поставили лайк статье

*Taqdim etilgan bozor tahlili axborot tavsifiga ega va bitim tuzish uchun ko'rsatma bo'lib hisoblanmaydi.

По всем вопросам контента просим обращаться по e-mail editorial-board@instaforex.com

По всем вопросам контента просим обращаться по e-mail editorial-board@instaforex.com

Juma kuni GBP/USD juftligi kuchli o'sish ko'rsatdi. EUR/USD tahlilidagi ko'plab kuzatuvlar GBP/USD ga ham tatbiq etilishi mumkin. Yevro kunlik 100 pipni oshirish uchun cheklangan sabablarga ega bo'lsa-da, funt sterlingning

EUR/USD valyuta juftligi juma kuni sezilarli o'sishni ko'rsatdi. Bizning fundamental maqolalarimizda ushbu trendni batafsil tushuntirdik. Bir necha hafta oldin, biz kunlik vaqt o'lchovida korreksiya yuz berishini bashorat qilgan edik

Juma kuni GBP/USD juftligi yuqoriga ko'tarildi. Yevro va funt sterling bir-birining harakatlarini yaqinroq kuzatmoqda, va ikkala valyuta juftligida yuqoriga qarab korreksiya rivojlanayotgan ko'rinadi. Juma kungi deyarli barcha hisobotlar Buyuk Britaniya

Juma kuni EUR/USD valyuta juftligi o'zining yuqoriga qarab harakatlanishini davom ettirdi, bu esa makroiqtisodiy ma'lumotlar tomonidan sezilarli darajada qo'llab-quvvatlandi. Oldin aytib o'tilganidek, faoliyat ko'rsatkichlari eng muhim indikatorlar emas. Shuni ta'kidlash

Ertalabki prognozimda men 1.2412 darajasiga e'tibor qaratdim va shu asosida savdo qarorlarini qabul qilishni rejalashtirdim. Keling, 5-daqiqali grafikni ko'rib chiqaylik va nima sodir bo'lganini tahlil qilaylik. 1.2325 yaqinida ko'tarilish

Ertalabki prognozimda men 1.0454 darajasiga e'tibor qaratdim va unga asoslanib savdo qarorlarini qabul qilishni rejalashtirdim. 5 daqiqalik jadvalga nazar tashlaylik va nima bo'lganini ko'raylik. 1.0454 darajasining buzilishi va qayta sinovdan

Payshanba kuni GBP/USD juftligi makroiqtisodiy yoki fundamental omillarsiz ham ko'tarilishni davom ettirdi. Kun davomida AQSh yoki Buyuk Britaniyada hech qanday muhim hisobot e'lon qilinmadi. AQShning ishsizlik da'volari hisobotida kutilgan natijalarga

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.