Alesh Loprays boshchiligidagi ekipajning g'alabalari tarixi sening muvaffaqiyating tarixi bo'lishi mumkin! Huddi shunday quvvatli savdo qil va ishonch bilan yetakchilikka intil, buni "Dakar" rallisining doimiy ishtirokchisi va "Ipak yo'li" rallisining g'olibi InstaForex Loprais jamoasi kabi amalga oshir!

InstaForeksga qo'shil va birgalikda g'alabaga erish!

14.01.2025 03:14

14.01.2025 03:14On Monday, the EUR/USD currency pair continued to trade lower—what else could it do? This situation reminds us of last year when we frequently noted that the euro was overbought and unjustifiably expensive. While predicting the exact timing of a new trend is always challenging, we cautioned that it might begin after September 18. The trend ultimately started on September 25, so the current decline of the euro does not come as a surprise to us. We've been discussing this scenario throughout 2024. It's important to recognize that prices can change direction regardless of the presence or absence of fundamental or macroeconomic factors; we refer specifically to local influences. When a clear trend is visible to all market participants, why would anyone choose to buy an asset that is consistently losing value?

It's important to remember that a currency pair's exchange rate is determined solely by supply and demand, rather than by macroeconomic reports or Federal Reserve speeches. The market forms a long-term opinion that aligns with the prevailing trend, based on global fundamental factors such as Fed monetary policy, economic crises, and geopolitical conflicts. This opinion influences trading and leads to long-term trends. Although local events and reports can affect trader sentiment over the course of a single day, they do not dictate the overall trend.

Currently, the euro may continue its decline against the dollar. While we cannot predict the exact level at which the pair will stabilize, there is no indication that the current trend is concluding. Looking at the weekly timeframe, it appears likely that the euro could drop below $0.95, potentially even lower. Although this possibility may seem hard to believe to some, just a few months ago, few anticipated a drop of 1,000 pips, and no analysts predicted a fall to parity.

The target zone we have mentioned several times has now been reached. The price has entered the range between 1.0000 and 1.0200, which we identified as the objective. Notably, no significant news was required for the euro to continue its decline on Monday. In the near future, a new upward correction may begin, but trading during corrections is generally not advisable. While we won't discourage anyone from attempting it, as long as the trend remains— even on the daily timeframe—considering long positions is not logical. This week, only the U.S. inflation report has the potential to bolster the euro. However, it's important to remember that no one can predict when market makers will start locking in profits on their short positions or how far they'll allow those positions to run.

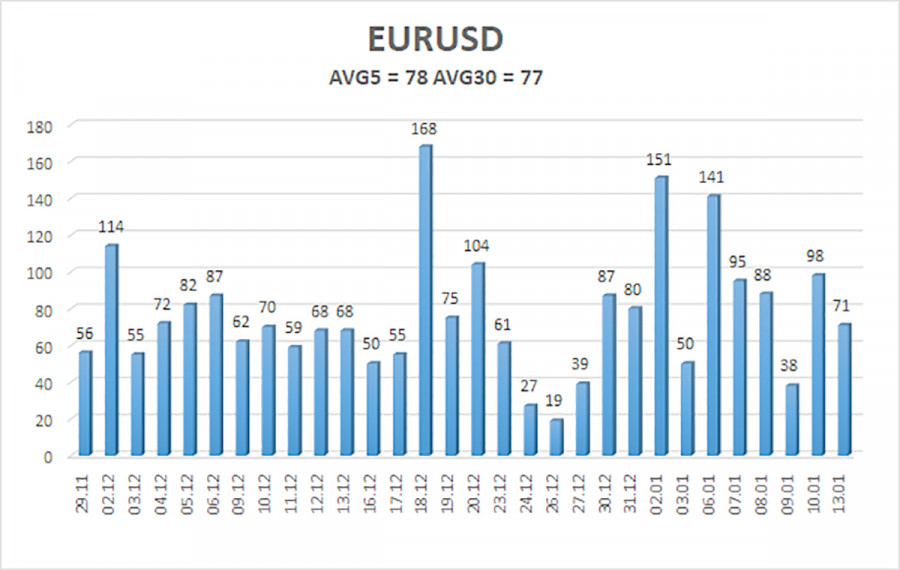

The average volatility of the EUR/USD currency pair over the last five trading days as of January 14 is 78 pips, which is classified as "average." On Tuesday, we anticipate that the pair will move between the levels of 1.0136 and 1.0292. The higher linear regression channel remains downward, indicating a continuation of the global downtrend. Recently, the CCI indicator entered the oversold zone twice and formed two bullish divergences; however, these signals only suggest a potential correction.

The EUR/USD pair is likely to continue its downtrend. In recent months, we have emphasized the expectation of further declines in the euro in the medium term. We firmly support the overall bearish direction and do not believe that this trend has ended. There is a significant likelihood that the market has already priced in all future Fed rate cuts. As a result, the dollar currently lacks medium-term reasons for a decline, apart from purely technical corrections.

Short positions remain relevant, with targets at 1.0193 and 1.0136. For those trading based purely on technical analysis, long positions can be considered if the price moves above the moving average, targeting 1.0437. However, any upward movement should be classified at this moment as a correction.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

Задайте их нашему топовому аналитику Михаилу Макарову. Присоединяйтесь к его интерактивному вебинару “Экономические события недели: Обзор, Анализ, Прогноз

На вебинаре вас ждет:

Регистрируйтесь на вебинар, чтобы быть в курсе всех рыночных трендов!

Вы сегодня уже поставили лайк статье

*Taqdim etilgan bozor tahlili axborot tavsifiga ega va bitim tuzish uchun ko'rsatma bo'lib hisoblanmaydi.

По всем вопросам контента просим обращаться по e-mail editorial-board@instaforex.com

По всем вопросам контента просим обращаться по e-mail editorial-board@instaforex.com

Gaz narxlari pasayib ketdi, bu AQSh tomonidan 1-fevraldan boshlab global savdo urushlarining boshlanishi mumkinligi sababli yuzaga kelgan keng tarqalgan pessimizmni aks ettiradi. Biroq, Donald Trampning EU mamlakatlarini faqat Amerika gazini

Kelgusi hafta muhim voqealar va iqtisodiy ma'lumotlarning e'lon qilinishi bilan global bozor dinamikasiga sezilarli ta'sir ko'rsatadi. Avvalo, o'tgan haftadagi asosiy siyosiy va geosiyosiy voqealarni ko'rib chiqamiz. Prezident Donald Tramp lavozimga

Juma kuni GBP/USD juftligi sezilarli o'sishni namoyish etdi. Bu harakatga Buyuk Britaniya va AQShdan kelgan PMI indekslari ta'sir ko'rsatgan bo'lsa-da, 150 punktlik o'sish faqat shu ma'lumotlarga asoslanganmi, degan savol tug'iladi

EUR/USD valyuta juftligi juma kuni sezilarli darajaga ko'tarildi, bu asosan yevroning foydali makroiqtisodiy ko'rsatkichlariga bog'liq edi. Yevrozonada va Germaniyada biznes faolligi indekslari nisbatan kuchli raqamlarni namoyish qildi, garchi ular ideal

Kelgusi haftaning iqtisodiy taqvimi muhim voqealar va e'lonlarga boy. EUR/USD savdogarlari Donald Trumpdan an'anaviy fundamental omillarga e'tiborlarini qaratishlari mumkin. Yanvar oyining oxirgi haftasidagi asosiy voqealarga yaqindan nazar solamiz. Chorshanba, 29-yanvar

Dushanba kuni kamdan-kam makroiqtisodiy voqealar kutilyapti. Germaniyada IFO Biznes Iqlimi Indeksi chiqariladi, ammo uning bozorda katta ta'sir ko'rsatishi ehtimoli past. Hozirda ikkala valyuta juftligi ham o'sishga moyil, va bozor ishtirokchilari

AUD/USD juftligi ikki kunlik savdo diapazonidan chiqib, yangi oyning eng yuqori darajasiga yetdi. Spot narxlar ijobiy harakatni ko'rsatmoqda va 50 kunlik SMA indikatoridan o'tib, AQSh dollari zaiflashuvi fonida yanada ko'tarilish

AQSh Dollar Indeksi (DXY) ketma-ket ikkinchi kun pasayishda davom etmoqda, yangi oylik minimumga tushib, kun ichida 0.40% ga yaqin payaydi va ketma-ket ikkinchi hafta ham zararni qayd etish yo'lida davom

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.